IRS 1023-EZ 2018-2026 free printable template

Show details

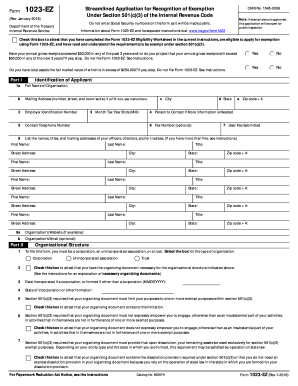

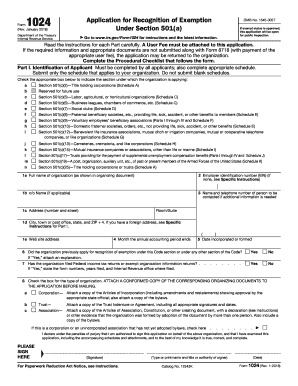

This form is used to apply for recognition of exemption from federal income tax under section 501(c)(3) of the Internal Revenue Code.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 1023 ez online application form

Edit your form 1023 ez online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1023 ez application online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1023 ez pdf online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 1023 ez form pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1023-EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 1023ezform

How to fill out using form 1023-ez and

01

Gather all the necessary information and documents required to complete Form 1023-EZ.

02

Download the Form 1023-EZ from the official website of the Internal Revenue Service (IRS).

03

Review the instructions provided with the form to understand the requirements and eligibility criteria.

04

Fill out the form electronically or print it out and complete it manually using black ink.

05

Provide accurate information in each section of the form, including details about the organization's name, purpose, activities, finances, and governance.

06

Attach any required documents, such as the organization's articles of incorporation, bylaws, and financial statements.

07

Double-check all the information provided and ensure its accuracy and completeness.

08

Sign and date the form.

09

Submit the completed Form 1023-EZ along with any applicable user fee to the IRS according to the instructions provided.

10

Keep a copy of the submitted form and any accompanying documents for your records.

Who needs using form 1023-ez and?

01

Form 1023-EZ is specifically designed for certain smaller nonprofits seeking recognition of their tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

02

Organizations eligible to use Form 1023-EZ include those with projected annual gross receipts of $50,000 or less in each of the next three years, and with total assets of $250,000 or less.

03

Religious congregations, churches, and integrated auxiliaries of churches are also eligible to use this simplified form.

04

However, some organizations are not eligible to use Form 1023-EZ, such as supporting organizations, successor organizations, and foreign organizations.

Fill

irs form 1023 ez pdf download

: Try Risk Free

People Also Ask about 1023 ez form

What are streamlined procedures?

The IRS Streamlined Filing Compliance Procedures is an amnesty program designed to allow people who were unaware of their filing requirements to come forward penalty free and get up to date on their expat taxes.

How long does it really take the IRS to process a tax return?

How quickly will I get my refund? We issue most refunds in less than 21 calendar days. However, if you filed on paper and expect a refund, it could take four weeks or more to process your return.

What is the penalty for streamline IRS?

The penalty is 5 percent of the highest aggregate amount. When making your submission, attach the certification to a Form 1040X for only the most recent tax year for which you filed an income tax return showing a zero change in tax. Please write “Streamlined Domestic Offshore” in red ink at the top of the Form 1040X.

How long does it take the IRS to process streamlined tax returns?

How long does the Streamlined Filing Compliance Procedure take? Typically, it takes the IRS around 90 and 120 days to process your streamlined tax returns.

What is streamline process IRS?

The streamlined procedures are designed to provide to taxpayers in such situations with. a streamlined procedure for filing amended or delinquent returns, and. terms for resolving their tax and penalty procedure for filing amended or delinquent returns, and. terms for resolving their tax and penalty obligations.

How to check status of streamlined application for recognition of exemption under Section 501 C )( 3?

After you submit your application If you submitted your application before the date indicated in the chart and have not been contacted, you can call the toll-free Customer Account Services number, Monday through Friday, 8 a.m - 5 p.m (local time), at (877)-829-5500 to check on the status.

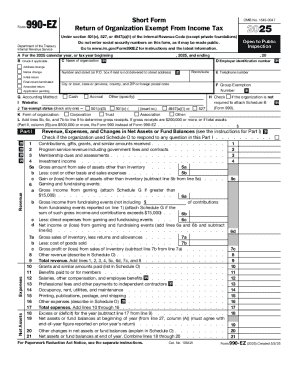

What happens if I use Form 1023-EZ and bring in more than $50 000?

The IRS has also said that a recognition letter may not be relied on by donors if it is based on “any inaccurate material information.” If you get more than $50,000 in a year, you will have to file at least a Form 990-EZ and bring yourself to the attention of the IRS.

How long does it take to get a 501c3 determination letter?

It may take 60 days or longer to process your request. You may also request an affirmation letter using Form 4506-B. The affirmation letter serves the same purpose for grantors and contributors as the original determination letter.

How to fill out Form 1023?

0:28 2:38 Learn How to Fill the Form 1023 Application for Recognition of YouTube Start of suggested clip End of suggested clip In lines 2 through 9 answering. Yes or no to each question. For part 7 & 8.MoreIn lines 2 through 9 answering. Yes or no to each question. For part 7 & 8.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 1023 ez online application online?

pdfFiller has made filling out and eSigning 1023 ez fillable easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out the irs form 1023 ez pdf form on my smartphone?

Use the pdfFiller mobile app to fill out and sign irs 1023 ez form download on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit irs form 1023 ez printable on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign template form 1023 ez right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is using form 1023-ez and?

Form 1023-EZ is the streamlined application for recognition of tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

Who is required to file using form 1023-ez and?

Small nonprofits with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to file for tax-exempt status using Form 1023-EZ.

How to fill out using form 1023-ez and?

Form 1023-EZ can be filled out online on the IRS website by providing all required information and answering the eligibility questions.

What is the purpose of using form 1023-ez and?

The purpose of Form 1023-EZ is to simplify the application process for smaller nonprofits seeking tax-exempt status.

What information must be reported on using form 1023-ez and?

Form 1023-EZ requires information about the organization's activities, governance structure, and financial information.

Fill out your IRS 1023-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

501C3 Application Form 1023 is not the form you're looking for?Search for another form here.

Keywords relevant to sample 1023ez form

Related to irs form 1023 ez online application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.