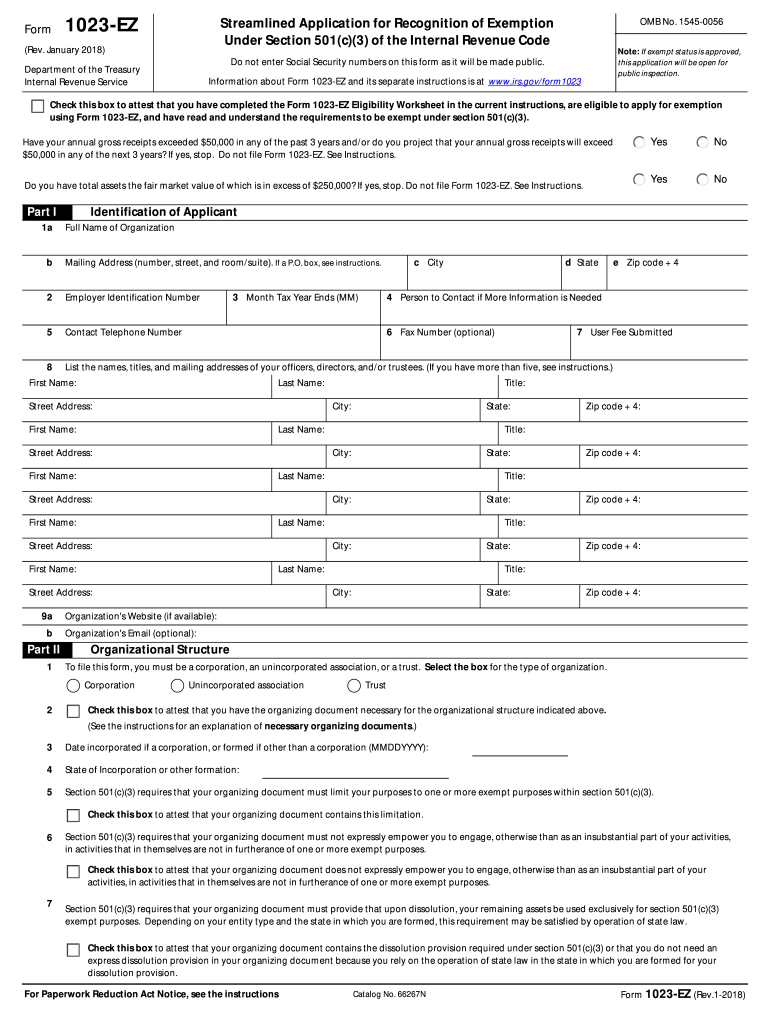

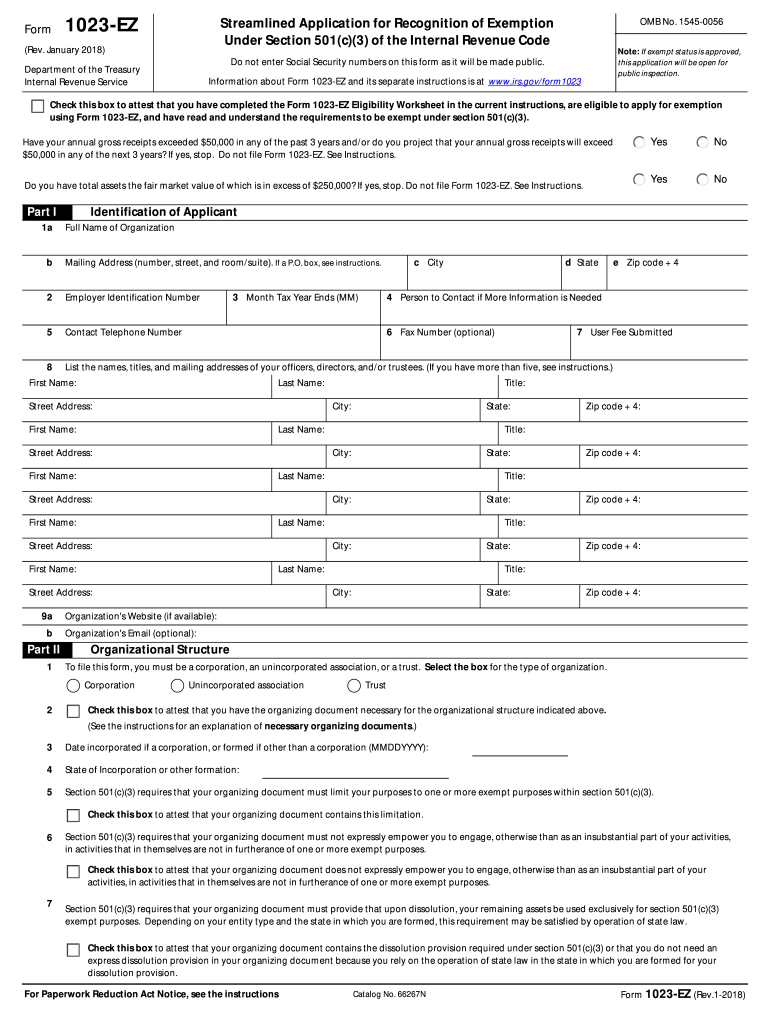

IRS 1023-EZ 2014-2024 free printable template

Get, Create, Make and Sign

How to edit fillable form 1023 ez pdf online

How to fill out form 1023 ez pdf

How to fill out 1023ez directions:

Who needs 1023ez directions:

Video instructions and help with filling out and completing fillable form 1023 ez pdf

Instructions and Help about irs 1023 ez instructions form

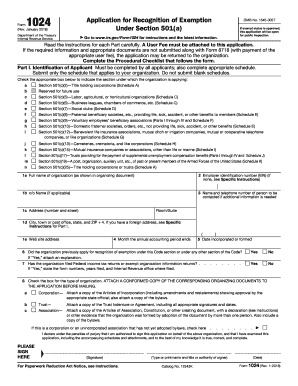

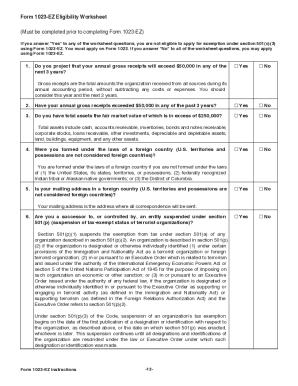

Hello my non-profit visionaries I know I have been missing in action for a little, but you know life lights and keeps laughing need to take a little break, but I'm back, and I figured the best thing that I could do right now that has been on my mind that I wanted to help you all with is that 1023 easy application and that's for filing for your 501c3 with the feds with the federal government because I have a lot of clients who come to me, and I've either told me that they someone has charged them like two thousand dollars, or you know something astronomical you know for them to do this paperwork, and so I want to make it clear there are two different versions of the 1023 application you have your traditional version which was it could be considered or is considered the long version of the 1023 form and that's where you have to attach your bylaws your conflict-of-interest form your past present and future activities you know you have said its involved right its involved and the fee for that application is eight hundred and seventy-five dollars so if someone is saying that they're going to help you develop that or fill that out that does entail a little of work if you do not already have templates my clients know I have templates for everything, so they don't have to worry about that but if you don't have templates then you're going to have to develop these and this is part of what you should have already been doing or thinking through as you're starting a nonprofit organization, so you should have these things you should have your bylaws you should have your conflict-of-interest form ready to go because you're going to need to attach them to 1023 or include them in the application, so it is a little more involved, but the fee is more expensive and that is if you know that you know you're in your plan is that you're going to raise more than 50000 and your first three years per year all right so each year you're going to be raising 50000 or more you already know that right you, and I'll tell you though you know the nonprofit piece and the projection of the budget it's a bit of you know it's like trying to psychic because you're making a projection you do not know whether this is the case unless you have a funder that has already said hey I'm gonna I can't wait for you to get your 501c3 status I have this money lined up for you, it's more than 50000 or you have a number of funders that are just waiting for you to get your 501c3 status, and you know that you're going to be bringing in 50000 or more, but that's then you make sure you do the traditional long form of 1023 easy which is eight hundred and seventy-five dollars for the fee and if you have someone else that comes in that does it for you, I don't know what their fees may be, but you know be careful with that you can also get an attorney pro bono to look over the paperwork and help you file the paperwork as well depending on what state you're in a lot of people you know a lot of firms do pro...

Fill 1023 ez form : Try Risk Free

People Also Ask about fillable form 1023 ez pdf

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

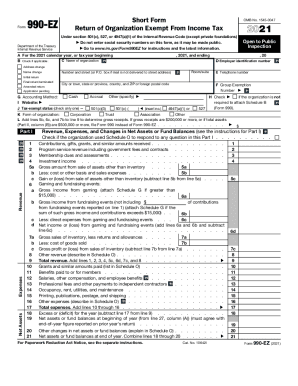

Fill out your form 1023 ez pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.